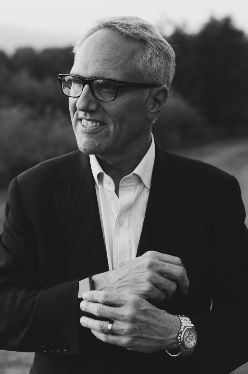

Todd Richter, a distinguished alumnus of the Kelley School of Business at Indiana University, has demonstrated his deep pride and appreciation for his alma mater. After obtaining his Masters of Business Administration in 1981, Richter embarked on a remarkable career as a renowned healthcare analyst on Wall Street. Presently, he holds the esteemed position of managing director within Bank of America’s global healthcare investment banking group. Recently, Richter translated his decades of professional accomplishments into a valuable opportunity for students, faculty, and the entire Kelley School community by establishing a $5 million endowment dedicated to fostering educational initiatives within the financial industry.

The establishment of the Todd Richter Fund has facilitated the provision of financial support across five distinct areas. This fund serves to bolster the resources available to both the Dean’s Office and the Graduate Finance Department, strengthening their ability to provide a comprehensive and enriching academic experience. Furthermore, the endowment enables the creation of graduate fellowships, exclusively available to Kelley School students who exhibit a keen interest in the study of finance or securities. Additionally, two professorships have been established, recognizing and rewarding faculty members with extensive expertise in the field of securities analysis—an industry that played a pivotal role in Richter’s own professional journey. Lastly, the endowment remains open to consider additional requests aligned with the aforementioned funding streams, provided that adequate bequest funds are available.

Todd Richter’s extraordinary commitment to his alma mater exemplifies his unwavering dedication to advancing education and empowering future generations of finance professionals. Through his generous endowment, he has positioned the Kelley School of Business to continue nurturing excellence in the study of finance and securities analysis, paving the way for continued growth and success within the field.